-

Faculty Win Healthcare Agreement!

We have terrific news to share: FAMCO and the administration have successfully come to an agreement to freeze faculty healthcare premiums again for 2023! We are also pleased to announce that the administration and FAMCO will resume negotiations in the weeks ahead to establish faculty healthcare premiums for 2024.

The FAMCO Executive Team and our Healthcare Bargaining Team want to send our recognition to the membership for your collective effort to protect our contract. Your willingness to take action together and share your concerns with President Leahy and members of the senior administration was instrumental in our ability to reach this extremely favorable outcome!

We are also very happy to say that this resolution marks a continuation of our positive collaboration with the administration, and we appreciate that President Leahy and his team have been receptive to the faculty’s needs and have been willing to work with us to honor our collective labor agreement.

We look forward to the new year moving ahead in this same spirit, and in the meantime, we sending everyone our best best wishes for a happy weekend and Spring 2023 semester!

-

Healthcare Negotiations/Grievance Update

By making unilateral changes to 2023 premiums and refusing to uphold their legal obligation to bargain, the Monmouth University administration is violating specific language in the University’s collective labor agreement and failing to uphold their obligations under the National Labor Relations Act. Despite these violations, FAMCO remains committed to working with the administration in good faith to productively and efficiently resolve this dispute internally, as we are invested in a positive labor-management relationship. Our collective labor agreement must be honored, meaning the administration must negotiate the terms of faculty healthcare with the union. FAMCO has proposed two remedies to these violations, and if MU administrators choose to refuse our proposed remedies (below), FAMCO is prepared to use all appropriate avenues available to protect our collective labor agreement.

Where We Stand Now

The administration continues to refuse to negotiate healthcare plans and rates for 2023 and 2024 because they do not like FAMCO’s proposals.

Instead of negotiating healthcare, the administration unilaterally imposed premium changes for faculty for 2023, increasing premiums for many, and unilaterally decided the basis for projected increases in 2024.

In response, FAMCO offered two options to the administration to resolve this dispute and uphold the contract:

- FAMCO proposed a Memorandum of Agreement (MOA) that would a) freeze 2023 faculty healthcare monthly premiums for the EPO plan, b) hold stable the rates for the Direct Access plan in 2023 as listed in the November 2022 open enrollment period, and c) freeze the 2024 premiums at the 2023 rates outlined above.

- FAMCO also filed a grievance against the administration for imposing 2023 rates for faculty that exceed the rates of administrators, and for the refusal to continue bargaining the terms of healthcare for 2023 and 2024 as required by our collective bargaining agreement. FAMCO is seeking the following two remedies in the grievance: a) a freeze of the 2023 premiums at the 2022 level, and b) the faculty and the administration return to the bargaining table to continue negotiating plans and rates for 2024.

FAMCO Grievance Meeting with President Leahy

January 9 (today), FAMCO met with President Leahy for Step 2 of the grievance process. In that meeting, President Leahy consistently indicated he understands FAMCO’s grievance and will think about the remedies we proposed. Also in that meeting, FAMCO repeatedly asserted our interest in resolving the matter productively and efficiently in an effort to maintain positive labor-management relations. FAMCO also asserted the importance of honoring our collective labor agreement which requires the administration to fully negotiate the terms of faculty healthcare with the union.

The University Can Afford FAMCO’s Remedies

For some perspective, the estimated total cost to the University to freeze faculty’s monthly healthcare premiums in 2023 would be less than $45,000.

In all, costs of healthcare to the university have remained relatively modest over the past six years, while the costs to employees increase significantly, meaning that MU administration has essentially made a profit from faculty healthcare premiums for years.

On top of that, there is also no dispute that the University saved over $2,000,000 last year by moving to a self-insured model, and by making changes to our pharmacy benefits program, which was all done after thorough research and dogged insistence by FAMCO and their own industry-expert healthcare consultant.

Those substantial savings mean that faculty should be paying less, not more, for healthcare at Monmouth. The bottom line is, an employer shouldn’t be making a profit on faculty healthcare premiums. The savings should go back to the employees!

-

Grievance Against MU Admin Incoming

FAMCO has officially filed a formal grievance against the administration for their refusal to return to the bargaining table to continue negotiating healthcare plans and rates for 2023 and 2024.

President Leahy recently announced his intent to freeze the 2023 monthly premiums for non-union employees in an attempt to divide university workers, but he is still unwilling to accept an agreement with FAMCO that would prevent an increase in 2023 monthly premiums for our faculty and guarantee our right to continue negotiating new rates for 2024. It seems President Leahy wants to take his ball and go home, walking out on making a good deal for faculty’s families.

For some perspective, the estimated total cost to the University to freeze faculty’s monthly healthcare premiums in 2023 would be less than $45,000. President Leahy is holding out on faculty over an amount this small.

With President Leahy’s team refusing to bargain any further on the health benefit needs of our members, FAMCO understands this is a violation of our current contract’s terms, and it also puts us on a path toward filing an unfair labor practice against the University.

We will keep members posted on the status of the grievance process as it unfolds, and our Contract Action Team will be reaching out to members directly for opportunities to get connected in the week ahead on efforts to hold the administration accountable for meeting their legal obligation to bargain with the union.

If you know that you want to be among those who are working to keep healthcare costs from increasing next year (when we know the University can, in fact, afford to keep those costs constant) then we encourage you to reach out to Sanjana Ragudaran directly, or any member of the FAMCO Executive Team, to get involved.

-

Admin Trying to Rewrite Health Benefits Bargaining and Leave the Table

Despite (empty) gestures to the contrary, the administration is trying to back out of health benefits negotiations, disrespecting our faculty trying to protect the health and financial welfare of their families and households. Hang a FAMCO Affordable Healthcare Benefits for All poster facing out your window to tell President Leahy you want the admin to go back to work at the bargaining table. See Beth Gilmartin-Keating in the English department to get your posters!

Despite FAMCO’s continued willingness to bargain in good faith, the University announced that it no longer intends to negotiate healthcare premiums or plan design changes with the union. They now claim they are entitled to revert to current contract language that (they believe) will allow them to increase 2023 and 2024 insurance rates for faculty!

In other words, while we all heard President Leahy announce premium freezes for employees for 2023, he has revoked his offer to extend that freeze to faculty and has removed his bargaining team from the negotiating table! This naked attempt at dividing university workers is shameful.

FAMCO has made it clear to the administration that, contrary to their attempt to unilaterally call it quits, they do, in fact, have a continued legal obligation to negotiate until our healthcare issues have been resolved through mutual agreement, or through formal dispute resolution after an impasse.

YOU can let the administration know you will not accept their attempt to play games with your healthcare–and you expect to see them back at the bargaining table NOW–by hanging a FAMCO Affordable Healthcare Benefits for All poster in your office window, facing out, to show the administration that you support FAMCO’s proposal for a 2023 rate freeze and 2024 contract reopener!

Reach out to your Beth Gilmartin-Keating in the English department to get your poster TODAY!

-

Important Health Benefits Bargaining Update!

Before President Leahy’s all-employee open call today, we want to update everyone on the status of our healthcare negotiations, as it seems Leahy may want to share decisions he has made, or intends to make, for non-union employees.

Be aware that any changes, or proposed changes, to our health benefits program that he may choose to discuss today have NOT been endorsed by FAMCO. Further, as of this morning, no proposed changes have been endorsed by ANY union on campus.

As of today, we have not been able to reach an agreement with the administration on any changes to our current program, including future costs, that our members have told us they would support. We expect negotiations to continue in good faith.

We also want to remind folks that the administration cannot make any changes to your health benefits, including your monthly premiums, without negotiating those changes with FAMCO.

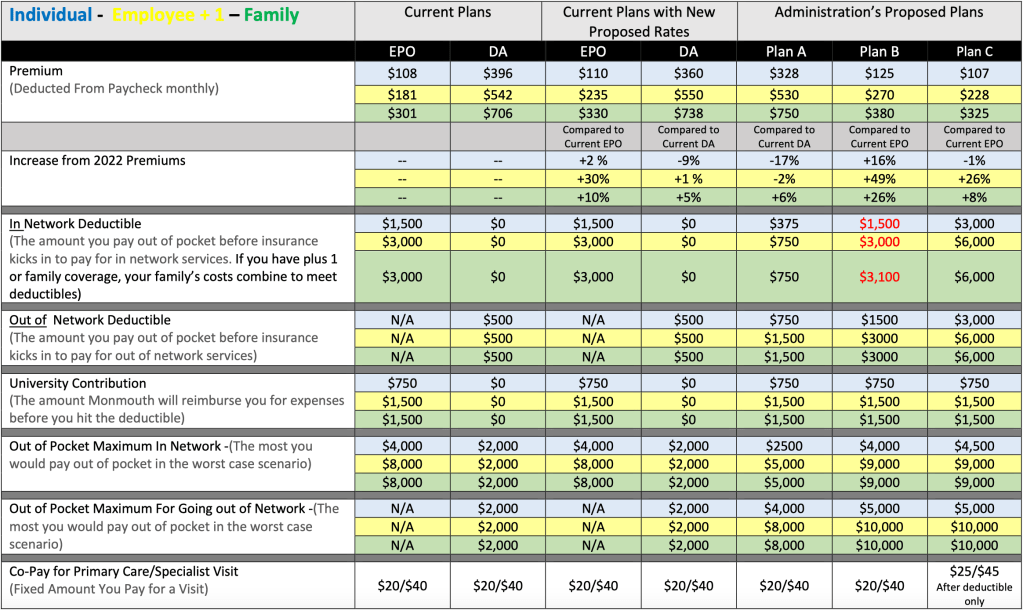

For those who have yet to have a chance to review FAMCO’s serious concerns with the administration’s current bargaining position, this post will conclude with an updated summary of how the administration’s proposal fails to align with our members’ stated needs as outlined in our FAMCO healthcare platform, and the following image is a updated side-by-side comparison table of the administration’s proposal:

*Additional design cost changes proposed by the administration available upon request.

**In network and out of network deductibles cross-apply for all newly proposed plans.

***For 2023/2024, the administration’s proposed premiums for the current DA will be 31% of the total costs for an individual and 24% for individual+1 and family; the proposed premium costs for the current EPO would be 13% of the total cost for all tiers. For the newly proposed plans, the proposed premiums would shift in 2024 to 12.25% of the total cost of the plans to the University. No further monthly premium figures have been proposed by the university.

Last updated: 11/10/22Also, for folks who did not see the front page article in last week’s Outlook covering faculty and staff union concerns about the administration’s proposed healthcare plans, you can read it here:

How Does The Administration’s Proposal Line Up To Our Platform?

Does their proposal lower premiums for all?

No. While some employees may see modest decreases in premiums if they were to switch to new plans, many would pay more, and some would pay MUCH more.

The current premiums have been held steady this year after FAMCO fought hard for a freeze during our last contract negotiations.

Premium freeze agreements have been one small step toward rectifying the unfair cost burden on employees. For example, from 2019-2022, the university’s premium costs decreased by 4% while faculty premium costs increased by 29%.

The reality of a current premium freeze to correct for past overcharging does not mean faculty should expect to pay more in 2023 or 2024 to “pay back” the university for any “gift of absorbing employee costs” in 2022, as might be implied by the administration.

In fact, employee premiums should be further reduced as the university is experiencing significant cost savings this year as a result of several changes in how we administer our health benefits. Those savings, which have not been fully included in the university’s projected 1.4% increase to the total cost of health insurance next year, should continue to be returned to the employees- not the other way around.

Does the proposal allow for plan choice?

The “choice” is in name only. There is NO CHOICE to stay on the current DA at lower premiums. There is NO CHOICE for a comparable DA plan after 2025 even at higher premiums. There is NO CHOICE for a plan with deductible levels that would not be a barrier to access combined with premium costs.

Does their proposal provide out of network benefits for all?

Out of network benefits “for all” is also in name only. The high deductibles and high out-of-pocket maximums make an “out of network benefit” inaccessible to many employees even if it exists in the plan. Adding an out-of-network benefit does not cost the university, but employee premiums are being increased anyway. Doesn’t add up.

Does their proposal provide for transparency in healthcare benefits decision-making?

No. Their proposal eliminates the healthcare labor-management committee the union has established for over three years.

Does their proposal address the problem of escalating healthcare costs?

As explained above, no. In fact, the administration has admitted in negotiations that they can financially afford the union’s proposals to lower premiums and allow real choice, and they have repeatedly rejected those proposals at the bargaining table.

—-

*Note: The administration has also indicated that they plan to bid out for new health benefits vendors as early as April 2023 (i.e. the University may move to another network, such as Aetna, or United Healthcare, for example, and/or may move to a new Rx benefits manager). That means that any changes in plan designs accepted now could be up for renegotiation in the year ahead.

-

Health Benefits Meeting Recap

FAMCO hosted a productive meeting for its members along with members of the campus staff union (OPEIU). FAMCO leadership presented the administration’s latest offer (about as bad as the last), and Barbara Caress (our health insurance consultant) provided expert commentary. Below, you’ll find the 30-minute presentation, a copy of the table from the video for reference, and an overview of how the latest offer measures up to FAMCO’s platform for health benefits.

The Administration’s Current Offer in Detail

This table is a big part of the presentation video above showing how the administration’s latest proposal compares to what we currently have in detail. Here it is for reference:

*Additional design cost changes proposed by the administration can be provided by request.

*The red deductible numbers in Plan B are a correction from the numbers displayed in the November 2, 2022 FAMCO update video presentation. The video number are (incorrectly) much lower.How Does the Administration’s Proposal Line Up with FAMCO’s Platform?

Does their proposal lower premiums for all?

No. While some employees may see modest decreases in premiums if they were to switch to new plans, many would pay more, and some would pay MUCH more.

Does the proposal allow for plan choice?

The “choice” is in-name-only.

There is NO CHOICE to stay on the current DA at lower premiums. There is NO CHOICE for a comparable DA plan after 2025, even at higher premiums.

There is NO CHOICE for a plan with deductible levels that would not be a barrier to access combined with premium costs.

Does their proposal provide out of network benefits for all?

Out of network benefits “for all” is also in-name-only.

The high deductibles and high out-of-pocket maximums make an “out of network benefit” inaccessible to many employees, even if it exists technically in the plan. Adding an out-of-network benefit does not cost the university more, but employee premiums are being increased anyway. It doesn’t add up.

Does their proposal provide for transparency in healthcare benefits decision-making?

No. Their proposal eliminates the healthcare labor-management committee the union has established for over three years.

Does their proposal address the problem of escalating healthcare costs?

No. In fact, the administration has admitted in negotiations that they can financially afford the union’s proposals to lower premiums and allow real choice, and they have repeatedly rejected those proposals at the bargaining table.

—-

The administration has also indicated that they plan to bid out for new health benefits vendors as early as April 2023 (i.e. the University may move to another network, such as Aetna, or United Healthcare, for example, and/or may move to a new prescription benefits manager). That means that any changes in plan designs accepted now could be up for renegotiation in the year ahead.

-

Special Member Meeting with Healthcare Consultant This Wednesday Night

Mark your calendars for a special member meeting this Wednesday (November 2) from 7pm-8pm on Zoom where our FAMCO healthcare consultant will explain the administration’s current proposal and FAMCO’s recommended response. We have also invited our good colleagues from the staff unions to join us for the update as well. All active FAMCO members will find an invite to the Zoom room in their email.

If you are enrolled in an MU health insurance plan and do not want to pay more for your current health benefits than you already do, we strongly encourage you to attend and make your voice heard.

In order for the bargaining team to move forward this week, we need to hear from you as we navigate this important crossroad.

-

Admin to Pitch Unapproved Health Plans to Non-Union Faculty–Data Inside

The administration and FAMCO have NOT reached an agreement about University health benefits, but the administration is barreling forward anyway. The plans on offer at upcoming “healthcare information sessions” with the HR benefits team DO NOT address the FAMCO Healthcare platform, and the administrations seems to be trying to push past that fact quietly. Presumably, these presentations are intended to divide university employees by isolating non-untoned employees.

Again, FAMCO has NOT AGREED to the these plans that the administration will, presumably, start presenting at upcoming “info sessions.” FAMCO believes ALL workers deserve clear information on their health benefits choices, so we made the table below.

Out-of-Pocket maximums are particularly important to pay attention to because you can still be charged certain fees and copays after meeting deductibles. It’s also important to note that in- and out-of-network maximums are added up separately, so meeting one does not automatically count toward the other.

FAMCO’s proposal is simple: extend the premiums freeze through July 1 and then lower current premiums 10% while keeping the Healthcare LMC active to properly design sound plans for all University workers. The Administration is trying to RUSH THROUGH these new plans.

Under these plans, faculty will pay more for these proposed benefits, both in higher deductibles and higher paycheck contributions, and deductibles compound the problems the less you are paid. These proposed increases more than cancel out recent cost-of-living and salary floor increases FAMCO’s last contract with the administration won.

Current Premiums Deducted from Paychecks Current Deductibles (In/Out-Network) Proposed Premium Deductions from Paychecks Proposed Deductibles(In/Out-Network) Out-of-Pocket Maximum(In/Out-Network)(What if I get sick? What’s the worst thing possible?) Current EPO

Employee

Employee+1

Family

Ends 2025

$108/month

$181/month

$301/month

$1500/NA

$3000/NA

$3000/NA

$112/month

$239/month

$335/month

No change

No change

No change

Ends 2025

$4000/NA=$4000+OON

$8000/NA=$8000+OON

$8000/NA=$8000+OON

Ends 2025Current DA

Employee

Employee+1

Family

Ends 2025

$396/month

$542/month

$706/month

$0/$500

$0/$1000

$0/$1000

$395/month

$560/month

$775/month

No change

No change

No change

Ends 2025

$2000/$2000=$4000

$4000/$4000=$8000

$4000/$4000=$8000

Ends 2025Admin Proposed “DA 500”

Employee

Employee+1

Family

$350/month

$538/month

$754/month

$500/$1000

$1000/$2000

$1000/$2000

$2500/$4000=$6500

$5000/$8000=$13,000

$5000/$8000=$13,000Admin Proposed “DA 1500/HRA”

Employee

Employee+1

Family

$130/month

$278/month

$390/month

$1500/$3000

$3000/$6000

$3000/$6000

$4000/$5000=$9000

$8000/$10,000=$18,000

$8000/$10,000=$18,000Admin Proposed “DA HDHP/HSA”

Employee

Employee+1

Family

$111/month

$239/month

$335/month

$3000/$3000

$6000/$6000

$6000/$6000

$4500/$5000=$9500

$9000/$10,000=$19,000

$9000/$10,000=$19,000Table comparing deductibles, premiums, and out-of-pocket maximums of the current health insurance plans and those most recently presented by the administration Deductibles discourage people from seeking care, meaning are likely to not get health issues diagnosed, will miss detecting problems early, or will recover slower from problems that need monitoring and detailed care plans. This could be one way the administration hopes to save themselves money in the long run. However, delaying getting healthcare causes more damage and makes it more expensive, both to faculty and, ultimately, the University as the health insurance provider. Deductibles make specialist care (like mental health services) harder to access because they are often out-of-network, subjecting them to higher deductibles and out-of-network maximums.

These increases will result in a severe pay cut for many. Our health care means more now than ever, and we deserve fair treatment. Why does President Leahy think it is fair to increase the cost of University workers’ and their family’s healthcare?

-

New Letter to the Editor: Open Letter to President Leahy

FAMCO and OPEIU leaders, Johanna Foster and Holly Davis, have published a letter to the editor in The Outlook, Monmouth University’s campus newspaper, addressed to Monmouth University President Leahy on the employee health benefits currently under negotiations. President Leahy has said, at recent campus events, that campus health and wellness are major issues for him this school year, but with the administration bowing out of bargaining sessions this week, and their general lack of preparedness at the last session, that claim is still just a sound bite.

Holly and Johanna’s letter speaks to the needs of the nearly 400 employees they represent who, along with Monmouth students, have been through a pandemic and now face inflation on top of the health and wellness concerns that predated, came out of, or were exacerbated by the pandemic. President Leahy and his administration cannot ignore these realities. Students, faculty, and staff all need good healthcare, and Monmouth University, as the health insurance provider, is directly responsible for the quality of care faculty and staff can receive.

-

ADMINISTRATION PROPOSES HEALTHCARE PREMIUM HIKES AS HIGH AS 57%, COMES SHOCKINGLY UNPREPARED TO BARGAIN

This time last year, FAMCO secured an important victory: a zero-percent increase in monthly healthcare premium costs for 2022. We also won the right to renegotiate healthcare costs and plan designs for 2023 and 2024.

For a year, FAMCO has been listening to members’ concerns about the critical need for affordable and high-quality healthcare, and submitted a proposal to the administration that does the following:

- Lowers monthly premium costs for all faculty;

- Provides the choice of either a traditional plan or a high deductible plan to all faculty;

- Provides out of network benefit options for all faculty, regardless of plan;

- Establishes formal channels of transparency to assess the overall costs of healthcare to the university.

On September 20, after several weeks to prepare a reasonable counter in line with faculty needs and significant pressure from FAMCO to come to the table, the administration came to the bargaining table with a counter proposal that utterly fails to take any real steps to meet the needs of our members.

Administration proposes healthcare premium hikes as high as 57% in 2023

Specifically, the administration has proposed the following monthly premium changes for our members. On all but one tier, the premiums are increased, and astronomically for faculty in the high deductible plans.

For faculty on the Direct Access Plan (PPO), the proposed monthly costs would be:

Individual: $356 per month (10% decrease)

Individual plus 1: $544 per month (.4% increase)

Family: $763 per month (8% increase)

For faculty enrolled in the high deductible plan proposed, the monthly costs would be:

Individual: $133 per month (23% increase)

Individual plus 1: $285 per month (57% increase)

Family: $399 per month (32% increase)

In reality, that would mean a faculty member earning $80,000 a year who enrolled in the proposed high deductible family plan, for example, could expect to spend an estimated 15% of their monthly paycheck on healthcare alone.

For a faculty member making $65,000 a year who would enroll in the proposed high deductible plan for an individual employee can expect to spend roughly 9% of their monthly paycheck on healthcare. If that same faculty member were to enroll in the proposed traditional PPO family plan, they can expect to spend a head-spinning 18% of their monthly earnings on healthcare!

For some further perspective on how unconscionable these proposed rate increases really are, the Affordable Care Acts sets the percentage an employee should reasonably pay for healthcare at 9.6% of an employee’s income, or else risking financial penalties for the employer.

For our good colleagues in administrative support positions who are paid considerably less than faculty at any rank, premium increases like these, if they were to be proposed by the university for support staff as well, would make it next to impossible for employees to enroll in university-sponsored healthcare plans.

Administration proposes new and higher deductibles for both plans that make access to care even more cost prohibitive

While the administration has stated they agree that plan choice and out of network benefit options are important for employees, their proposal does not accomplish those goals. Instead, the administration proposal includes plan design choices and out of network benefit options that are in name only.

In the administration’s proposal, all employees would have to meet a deductible for care ranging anywhere from $500 to $3000, depending on the plan. For out of network benefits, faculty would need to pay anywhere from $1000-$6000 in deductibles and only after the in-network deductible has been met!

For perspective, this means that a faculty member in the highest income brackets making $100,000 a year would have to spend the equivalent of nearly an entire month’s paycheck to meet an out of network deductible if they were on the proposed high deductible family health plan. For faculty in the lowest income bracket, it could mean spending closer to a month and a half’s worth of a paycheck before they could meet their deductible.

With deductible levels this high, an out of network option is really no option at all.

If we were to combine the outrageous proposed increase in premiums, shockingly high deductibles, and the crisis of inflation together, faculty can effectively watch the 3% salary increases we won for 2023 and 2024 disappear.

The administration’s proposed healthcare cost increases effectively wipe out any across the board raises for 2023 for many faculty.

In fact, for many, that 3% salary increase combined with healthcare costs increases, would, in effect, become a salary cut.

For example, for a faculty member earning $75,000 a year on the proposed traditional family plan, their 2023 raise of 3% could amount to roughly an 1.2% pay cut. If that same faculty member were to enroll in the proposed high deductible family plan, they could expect that their 2023 raise of 3% could, in effect, amount to a roughly 1.7% pay cut. For a faculty member earning $65,000 who enrolls in the high deductible family plan, their estimated salary cut would be closer to 2%!

When questioned on how the administration could possibly think any of these increases to the cost of employee healthcare reflects the values of a decent employer, particularly given the millions in savings they have incurred in moving to self-insurance, the university provided no explanation other than to say they believe it to be fair.

ADMINISTRATION CAME UNPREPARED TO BARGAIN

In shockingly bad form, the administration came to the bargaining table unprepared to justify this unconscionable proposal, almost to the point of risking a bad faith bargaining charge with the National Labor Relations Board when it became clear that all members of the administration team had not read the proposals on the table. Although both parties had agreed to bring expert consultants to the session to assist in moving the discussions forward with greater clarity and speed to meet open enrollment schedules that would benefit our members, the administration failed to share their proposal with their own consultants in advance of the session. As a result, the administration’s consulting firm had no basis to understand the important questions FAMCO was prepared to ask the administration about their proposal on behalf of our members.

When FAMCO made clear that such behavior amounted to a statement of disrespect for the faculty and showed they lacked serious intention to negotiate, the administration conceded their error and agreed to revise their counter proposal to begin again in earnest next session. We expect the administration team to return with a revised counter proposal that moves toward the clear and reasonable needs of faculty and their families.

TAKE ACTION TO DEMAND A GOOD FAITH PROPOSAL!

There are two things you can do today in 5 minutes to help move the administration closer to faculty on healthcare:

-

New Letter to the Editor: Open Letter to President Leahy

FAMCO and OPEIU leaders, Johanna Foster and Holly Davis, have published a letter to the editor in The Outlook, Monmouth University’s campus newspaper, addressed to Monmouth University President Leahy on the employee health benefits currently under negotiations. President Leahy has said, at recent campus events, that campus health and wellness are major issues for him this school year, but with the administration bowing out of bargaining sessions this week, and their general lack of preparedness at the last session, that claim is still just a sound bite.

Holly and Johanna’s letter speaks to the needs of the nearly 400 employees they represent who, along with Monmouth students, have been through a pandemic and now face inflation on top of the health and wellness concerns that predated, came out of, or were exacerbated by the pandemic. President Leahy and his administration cannot ignore these realities. Students, faculty, and staff all need good healthcare, and Monmouth University, as the health insurance provider, is directly responsible for the quality of care faculty and staff can receive.